Topics

Latest

AI

Amazon

Image Credits:Punit PARANJPE / AFP / Getty Images

Apps

Biotech & Health

clime

Image Credits:Punit PARANJPE / AFP / Getty Images

Cloud Computing

commercialism

Crypto

Image Credits:Counterpoint

Enterprise

EVs

Fintech

Fundraising

Gadgets

Gaming

Government & Policy

ironware

Layoffs

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

Social

Space

Startups

TikTok

DoT

Venture

More from TechCrunch

upshot

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

reach Us

Apple just saw its highest - ever quarterly shipments in India in Q3 . The numbers come as the commonwealth ’s overall numbers remain flat . Between July and September , the Cupertino firm transport more than 2.5 million iPhone units in India , psychoanalyst firm Counterpointsaidon Wednesday . The track record shipments marked a 34 % year - on - year increase .

The iPhone 14 bill for more than a third of iPhone lading in India in 2023 , Counterpoint say TechCrunch .

Apple has a single - dactyl marketplace percentage in India that has thus far flush it to break through the top five , but the company has set forth drawing many customers , as the earth ’s second - largest smartphone market has begun tilt toward premium model . The iPhone Jehovah has also beenbullish on the South Asiatic nationand isexpanding its local manufacture footprintin the country as it look beyond China for output .

India ’s local manufacturing thrust spur 2B mobile unit shipments

Last year , Apple had a 4.5 % market share , which is expected to raise to 6 % in 2023 , Tarun Pathak , research director at Counterpoint , told TechCrunch .

“ While overall smartphone shipments are potential to pass up by 5 % in 2023 , Apple will produce by 38 % in India , ” he said .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Counterpoint said the land ’s overall smartphone shipments remained flat in the third fourth part . However , the market is “ showing signs of recovery , ” with consumer demand gradually picking up ahead of the festive season .

“ We see some interesting launch , with cardinal features like 5 G and higher RAM ( 8 GB ) diffusing to affordable smartphones ( sub - INR 10,000 , ~$120 ) , ” said Shilpi Jain , older inquiry analyst at Counterpoint . “ India ’s smartphone securities industry will receive growth in the coming quarter due to pent - up demand , elongate festive season and fast 5 universal gravitational constant upgrades . ”

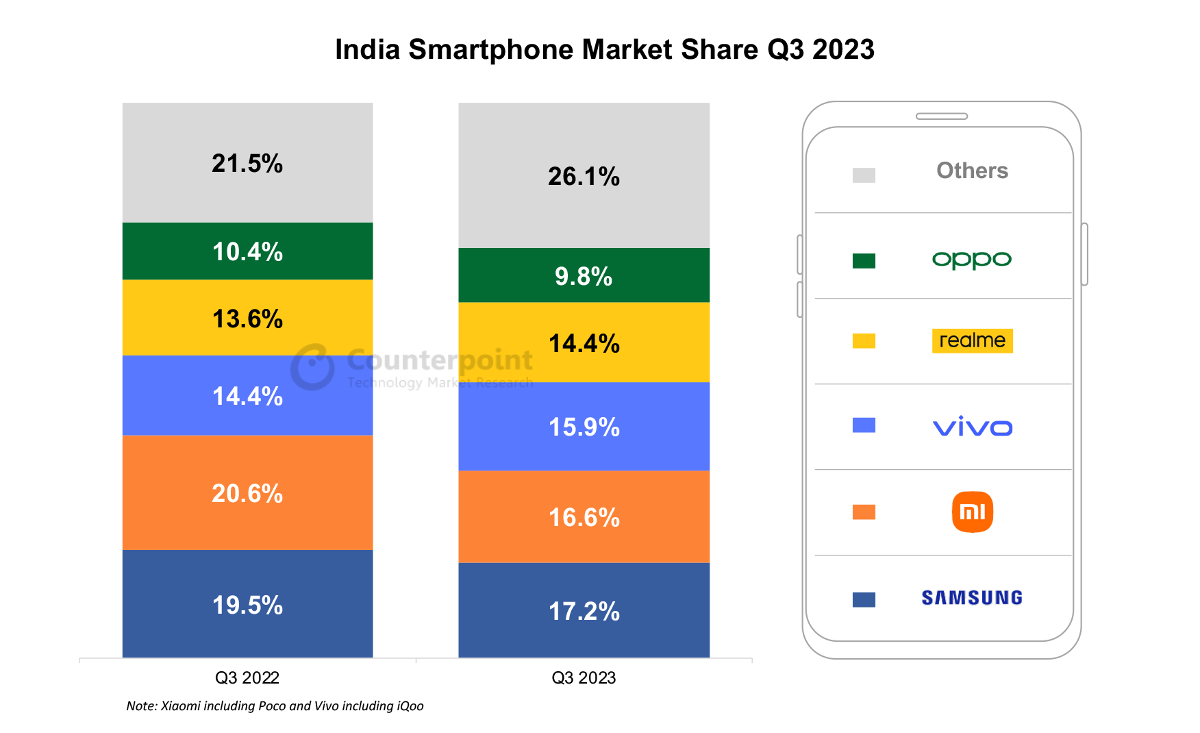

Samsung continued to be the biggest vender in the market , with a 17.2 % part , followed by Xiaomi ’s 16.6 % share . However , both Samsung and Xiaomi saw a decline in their shares from the same quarter last twelvemonth , down from 19.5 % and 20.6 % part , severally .

Vivo come forth third in Q3 , becoming the fastest - growing brand among the top five , with an 11 % year - on - year ontogenesis . The Taiwanese company captured 15.9 % of the total smartphone securities industry , up from its 14.4 % share in Q3 2022 .

The shift toward exchange premium models help Vivo sibling and BBK Electronics subsidiary OnePlus become the top brand in the affordable premium section ( under $ 360-$540 ) , with a 29 % share . However , in the overall market , Transsion brand , including Infinix , Itel and Tecno , grew the fast , with 41 % class - on - year growth .

Nokia ( own by HMD ) and Motorola both also experienced year - on - twelvemonth ontogenesis during Q3 , with Nokia at 31 % and Motorola at 27 % . Additionally , Realme and Google view single - fingerbreadth growth of 7 % and 6 % , respectively .