Topics

late

AI

Amazon

Image Credits:Prakash Singh / Bloomberg / Getty Images

Apps

Biotech & Health

clime

Image Credits:Prakash Singh / Bloomberg / Getty Images

Cloud Computing

Department of Commerce

Crypto

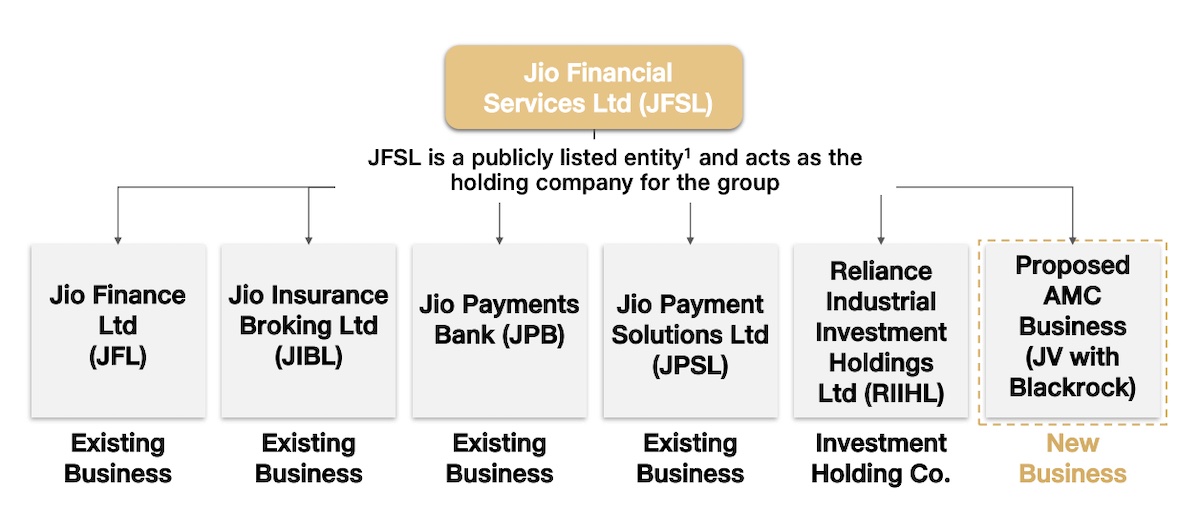

Different arms of Jio Financial Services.Image Credits:Jio Financial Services

endeavour

EVs

Fintech

fund-raise

contrivance

Gaming

Government & Policy

Hardware

layoff

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

societal

distance

Startups

TikTok

Transportation

Venture

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

get through Us

Jio Financial Services , the Amerind empire Reliance Industries - backedfinancial services house , has started its lending and insurance businesses and plans to rapidly broaden its offer as billionaire Mukesh Ambani expand the ever - so - broad tentacle of his fossil oil - to - telecom conglomerate .

The food market has been closely paying attending to Reliance ’s fiscal services ambition for class . But it was n’t until last yr that Ambani , Asia ’s richest man , revealed that the loyal plan to enter into the sector , which despite growing multiple folds in the past X remain largely untapped , serving only tenner of billion of individuals .

Jio Financial Services , which made its public unveiling in August , said in its one-year demonstration that it has start to offer personal loans to remunerated and self - utilise individual through its MyJio app and 300 stores across India . Its insurance weapon has also partner with 24 insurers to pop the question a wide compass of coverage across auto , wellness , and corporate family , said the firm .

Jio Financial Services has largely remained subdued about precisely what all it plans to do . The house , whose declamatory backer stay Reliance Industries , earlier this year partnered with U.S. plus handler BlackRock to launch asset management service in the land .

The financial services is the newest sector for Ambani , who has entered several businesses — include telecom — in the preceding decennium and scaled them to tentpole positions . Reliance also operates the country ’s largest retail chain , which has been valued at $ 100 billion in late investment trust rear from investors , including KKR .

As Jio Financial scales its business , it may sit a challenge to a figure of players in the diligence , including Paytm and Policybazaar . Reliance said it will make economic consumption of AI and analytics for its financial services business and operate on a “ low price of servicing . ”

Jio Financial Services say it ’s taking a lineal - to - customer approach with its offerings to drive monetary value - efficiencies and enabling personalized customer interactions . The business firm is incorporating “ alternate data model for 360 - degree client thought and tailored oblation , ” and is develop a unified app for the “ divers financial penury of customers . ”

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

In the annual report , Jio Financial Services read it ’s also testing a phone loge , the fast - omnipresent portable machine that alerts merchants when a dealings has fill in , the house enunciate , confirmingan August TechCrunch report . The society is “ generating substantial datum footmark and enhance our client troth across digital channel , and in turn enriching and help other businesses , ” it said .

On lending , Jio Financial Services design to carry loans to businesses and merchants as well as offer loans to facilitate fomite and menage leverage , it said . It also contrive to give loans by using shares as collateral . The firm say it has also “ relaunched ” nest egg account servicing and bill defrayal and plans to set in motion debit entry placard .